The home ownership rate in NZ is currently the lowest it has been in 66 years (approx 63%).

It peaked at a high of 73.8% back in 1991 and has been falling ever since. So what’s happened since then? We can all agree, I hope, that a higher home ownership rate is a good thing for families, for children and for our society as a whole. So how do we improve it?

Is a Labour government or a National government better for first home buyers?

Disclaimer: First up, I am aware of the age old saying – never discuss religion or politics in public. So please accept this post as intriguing info that is potentially worth pondering. I am not attempting to promote any particular political agenda and encourage you to complete your own due diligence on who you vote for.

With that disclaimer out of the way and at the risk of exposing myself to heated opinions, let’s have some fun!

You only get an election every 3 years anyway, right?

A little background…

Since I was young, I was always told that a Labour government was good for the real estate market, at least in Wellington anyway. Labour encouraged more job-creation, especially in government departments, resulting in more confidence and more money flowing around, which would naturally lead to positive growth in house prices. The flip-side is, Labour open the coffers, spend up large and get the country into debt.*

*Some would argue our Country is like a young family – we can afford a bit of debt to help us get ahead in life. Tough to buy your first home without a mortgage, right?

But is all this actually true? Which government is better for first home buyers? Which party is better for the real estate market in general?

The stats available go back to 1992 which ties in nicely with the last 3 long term governments:

National (Bolger et al): October 1990 – November 1999

Labour (Clark & Co): November 1999 – November 2008

National (Team JK): November 2008 – September 2017?

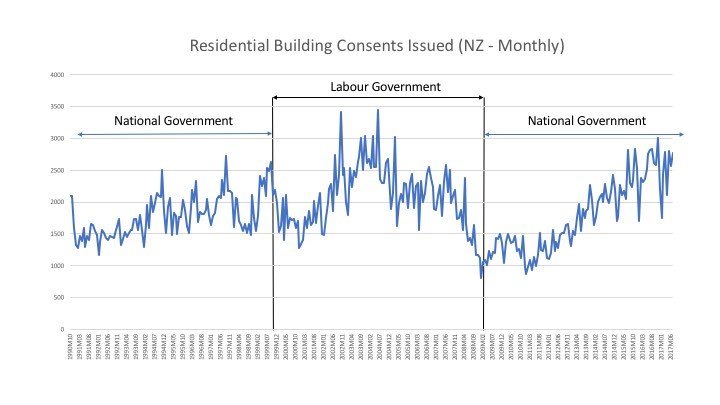

Factor 1. New Residential Building Consents.

Which government oversaw more new houses being built?

The chart speaks for itself, but the breakdown is even more telling.

Average monthly new building consents issued (NZ wide):

| Government | Period | Monthly avg | 9 year total |

| National | Oct ’90 – Nov ’99 | 1,792 | 197,079 |

| Labour | Nov ’99 – Nov ’08 | 2,093 | 226,042 |

| National | Nov ’08 – Sep ’17 | 1,751 | 182,121 |

Building consents are a tricky business and there are a lot of factors that go into it. Including availability of builders, red-tape, availability of land etc. Plus, not all consents end up being used so an issued consent doesn’t guarantee a new home was built. Others will be able to comment further on the reasons behind those figures. Nonetheless, those are some impressive numbers!

On average, 300-350 more new residential building consents were issued under Labour every month (these numbers don’t include alteration consents). This works out to an extra 3,600 – 4,200 new building consents per year.

That amount of new builds would put a reasonable dent in the excessive housing shortage we have right now. Even at the low end (3,600 new consents per year) that could have added an extra 32,400 new homes to the pool of available housing over the last 9 years.

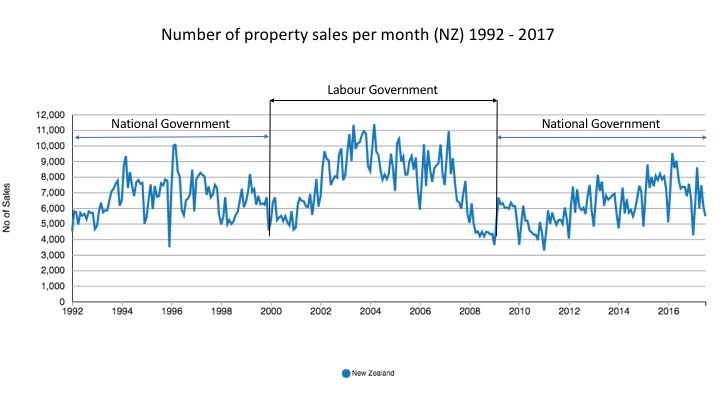

Factor 2. Monthly Sales Volumes (NZ wide)

Under which government did we see more properties change hands each month?

Again, the numbers speak for themselves. Oh for those glory days of 2003 – 2007!

Average monthly property sales under each government (NZ wide):

| Government | Period | Monthly sales (Avg) |

| National | Oct ’90 – Nov ’99 | 6,661 |

| Labour | Nov ’99 – Nov ’08 | 7,637 |

| National | Nov ’08 – Sep ’17 | 6,198 |

Why does this matter? Turnover is everything in a real estate market. More sales each month results in more choice for buyers. This can only be a good thing for those trying to get into the market. It also makes it easier for existing owners to ‘trade up’ which in turn means they then sell their existing property to a first home buyer. And the circle of life continues! Up to 1400 more properties changed hands every month under a Labour government.

In a slow market with low volumes, owners are more likely to ‘stay put’ because there isn’t much on the market to choose from. They are unlikely to find a house they desire enough to warrant going through all the stress and hassle of moving.

Right now, no one is building warm, single-level, 2-3 bedroom homes for retiring baby boomers to move into, which stops them selling their big family homes in the burbs that they no longer need (and in some cases can no longer even afford to keep warm). This has been seriously holding up the flow of potential first home buyer-type properties coming on the market for years.

Read: The real problem facing first home buyers right now

Since 1992, the 10 highest turnover months all occurred under a Labour government:

| Period | Median Sale Price | No of Sales (NZ) | Median Days to Sell |

| Mar 2004 | $240,000 | 11378 | 28 |

| May 2003 | $210,000 | 11337 | 34 |

| Mar 2007 | $342,500 | 10939 | 28 |

| Oct 2003 | $227,000 | 10924 | 25 |

| Nov 2003 | $235,000 | 10774 | 25 |

| Mar 2003 | $200,000 | 10746 | 30 |

| Sep 2003 | $215,000 | 10688 | 25 |

| Mar 2005 | $280,500 | 10434 | 28 |

| Aug 2003 | $215,000 | 10223 | 27 |

| Feb 2005 | $270,000 | 10174 | 32 |

Meanwhile, 8/10 of the lowest turnover months occurred under a National government…

| Period | Median Sale Price | No of Sales (NZ) | Median Days to Sell |

| Jan-11 | $340,000 | 3257 | 53 |

| Dec 1995 | $140,000 | 3491 | 34 |

| Jan 2009 | $320,000 | 3619 | 62 |

| Jan 2010 | $350,000 | 3628 | 44 |

| Oct 2010 | $353,000 | 3939 | 43 |

| Jan 2012 | $354,000 | 4038 | 48 |

| Aug 2008 | $330,000 | 4190 | 57 |

| Jun 2008 | $335,000 | 4197 | 55 |

| Jan 2017 | $485,500 | 4251 | 41 |

| Sep 2010 | $350,000 | 4281 | 44 |

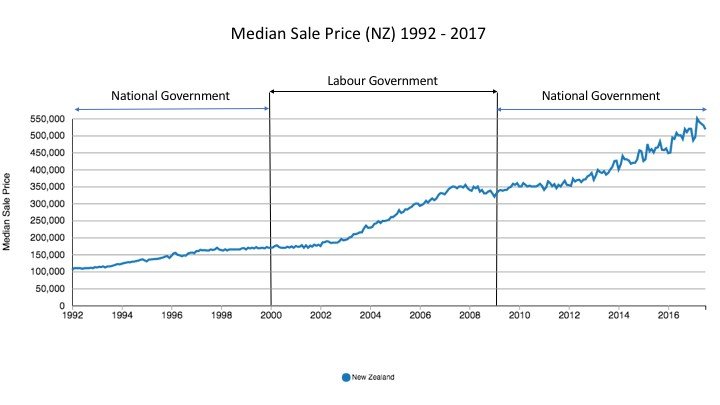

Factor 3. Median Sale Price

Does the government have an effect on the median sale price? Is the crazy recent price growth an anomaly? Is it partly a result of National being in charge?

Pretty consistent really. Both governments oversaw big housing booms with massive price growth.

So what caused all this?

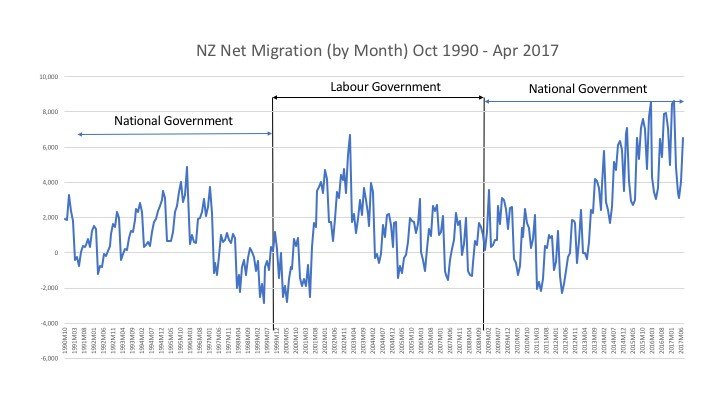

I can’t work it out. I’ve even analyzed Net migration numbers over the same period and can’t see any massive reason for the differences highlighted above:

So what else could be involved? I’ve gone back and reviewed all major policy decisions made by the Helen Clark Labour government. I can’t find a single policy that would have caused the differences in turnover and building activity. I can’t even find a single housing policy of note.

Now, before all you National voters blow a gasket…

Correlation does not equal Causation

Ever heard that one before? Just because consistent increases in monthly sales volume and new residential building consents occurred under a Labour government doesn’t mean they were caused by a Labour government.

Were there other factors at play during all these years? Yep, no doubt. In 1990 I was only 6 years old so I am in no place to comment on the economic landscape at that time.

In Conclusion

Am I cherry picking data to ascertain an interesting conclusion? Possibly.

Is it still worth sharing? I think so.

Based on the data above: If you are looking to buy your first home and you want to have an easier time getting into the market, then based on historical performance you would definitely need to consider voting for Labour. There is a lot more to it than just housing influence though so check out all party policies before you vote.

Do you work in real estate? Then based on the numbers above you definitely should be voting for Labour! Look at all those extra sales you could be missing out on right now!! 🙂

All joking aside…

A few peeps I have canvassed from the older generation offered the thought that National governments are usually elected in times of caution and restraint. National was elected in Oct 1990 as the Country was still reeling from the after effects of the ’87 stock market crash. National was elected again in November 2008 in the midst of the global financial crisis.

Meanwhile, Labour is elected in times of confidence, while the nation is potentially feeling more socially responsible, ready to spend more money to invest in infrastructure and to help those less fortunate (building more state houses etc).

PS. I’d just like to make a shout out to Statistics NZ regarding their infoshare platform, the source of the data on new residential building consents and net migration numbers featured above. Amazingly easy to use.

PPS. Make sure you enrol to vote and have your say people!

Further reading: This cool page on the NZ Herald website lets you compare the performance of Labour vs National over the last 18 years.

That was a great read, thank you!

Thanks Chloe, glad you enjoyed it!

Interesting article Andrew, but I’d disagree with your basic assumption that higher home ownership rates are good for families children and society as a whole.

Look to Germany as an example, their home ownership rates are substantially lower than ours (51% vs our 63%) yet they have a much lower Gini coefficient than us (less income inequality), their house prices have remained flat for 30+ years (in real terms), and they have some of the best housing stock in the world (no damp mouldy homes).

The difference? They tax imputed rent.

In NZ we have and unhealthy obsession with property that needs to change (becoming like Germany would of course hurt real estate agents).

I’m sure you can guess who I’m voting for.

Hey Daniel, thanks for your comment. Have just been doing some reading on imputed rent and it looks like an interesting idea. Here is the wiki link for anyone else interested:

https://en.m.wikipedia.org/wiki/Imputed_rent

I do think there are too many incentives for property investors in NZ (which perpetuates the obsession) and that needs to change. I’m a fan of anything that makes housing more affordable, even if it hurts agents ?

Hi Andrew

I don’t know if I am a typical landlord, just one house (which was my home for 12 years). I am very reluctant to continue being a landlord and once the current tenant has moved out (family member this time) I intend to repair the earthquake damage and sell. I have no real desire to offer someone (a stranger) my home anymore. Its not so much that the incentives have reduced, its the risk of damage/unpaid rent etc. Its just not worth the stress! So I wonder how many others are like me, never put a foot wrong as a landlord, provided a lovely well cared for home, and been put off by tenants who never lift a finger, have high demands, and don’t hesitate to leave you with unpaid rent and a pile of mess to clean up. Hope there are solutions to this housing crisis, but I am afraid I am not going to be helping for much longer.

Andrea I’m not saying you don’t have legitimate grievances but there are as many bad landlords as there are bad tenants.

Andrew thank you for putting such effort into this analysis. If you can’t “work it out” so to speak, factor in the inflation of lending explanation e.g. http://positivemoney.org/issues/house-prices/; http://positivemoney.org/2012/09/infographics-why-are-house-prices-so-high/.

Two National periods were after serious Worldwide financial meltdowns…1987 and 2007… i think you’re comparing apples with oranges..

Having a job and disposable income is essential to building houses…

I am more interested in how National achieved steady growth after the 2007 financial crash that some countries are still reeling from…10 years later.

If it aint broke, dont try fix it.

I once saw a bumper sticker which said ‘don’t vote, it only encourages them’. I’m starting to see the point of it.

House movers are under represented in the market stats at the moment, compared with first home buyers and investors at around 33% each in Wellington. Does this mean that home owners can’t find a better house to move to as you postulate Andrew, or that they have no need to move because they are content and settled where they are? It might be under the Labour monthly sales volume stats above that jobs were not secure and people needed to move frequently to new jobs. I have no evidence of either of these statements, just hypothesizing. I certainly have no preference for any party presently, so I can’t endorse any one over another.

I have observed though that all the efforts put into ‘taming the housing market’ and ‘helping first home buyers’ have made very little difference to the actual market dynamics. Many of the policies, such as loan to value ratios, actually help investors get more property, which wasn’t intended by the policy. I think market forces are mostly independent of Government policy, we just use that to justify our actions, and see meaning in randomness.

Wouldn’t it be nice if the government actually governed things they were good at (providing infrastructure and international relations being two I can’t practically do for myself) and kept out of most domestic matters (which I can do for myself)?

I’m still seriously contemplating whether or not I should encourage any of them…

Such a great point! Thanks Jackie. And yes, many policies don’t end up having the intended effect – like LVR ratios which, in big Cities seem to result in situations where most young couples can only raise a deposit with help from family.

I would like to suggest that perhaps the lower number of consents issued under the latest national leadership era could also be directly related to the difference in disposable income people have.

Living costs are increasing at a rate of knots everything from food to council rates have increased far beyond what people can easily afford, and incomes have not increased at the same speed. Therefore less money to spend and less applications for building consents perhaps?

Add to that the lack of suitable and affordable land?

And of course as you say National was elected during a time of caution, all those things would equate to lower building consent applications surely?

Hey Jenny, good points. Certainly fewer people would feel confident investing in building a new home when avocados are $6 each. I imagine building costs per square metre must have gone up dramatically since then too, as standards and materials improve. Thanks for commenting!

Yes, i believe the economic landscape has had a major effect on these figures. As you yourself said

“…National governments are usually elected in times of caution and restraint. National was elected in Oct 1990 as the Country was still reeling from the after effects of the ’87 stock market crash. National was elected again in November 2008 in the midst of the global financial crisis.

Meanwhile, Labour is elected in times of confidence, while the nation is potentially feeling more socially responsible, ready to spend more money to invest in infrastructure and to help those less fortunate (building more state houses etc)…”

I also remember 2003 as being a boom in the housing market, certainly prices in the Waikato doubled in that time.

I would NOT base your electoral vote on these figures, as there is no provable conclusions to draw. I also suspect there are more issues than just housing at stake.

Hi Richard, thanks for your comment. Certainly many more issues than just housing at stake, I agree. The next few weeks will be interesting!