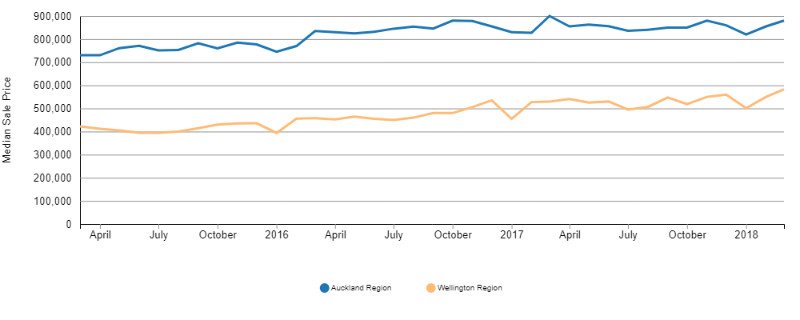

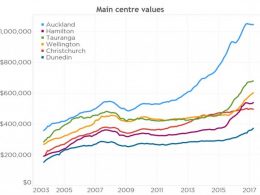

House prices have gone a little crazy over the past 3 years…

Median sale price (Auckland vs. Wellington 2015 – 2018)

It’s enough to make you think you would be better off renting. Isn’t it crazy to buy a house in this sort of environment? If you are young, in your 20’s or 30’s, aren’t you better off not being tied down, free to suddenly jump ship and go on your O.E anytime you like?

I’m here to argue that home ownership is still a valid and worthwhile goal for young people in New Zealand and the sooner we buy a house the better. Think I’m nuts? I’ll try my best to persuade you…

1. Home ownership is attractive to the opposite sex.

Let’s get straight down to it. Home ownership is sexy. Am I right? Love is not about money and money cannot buy you love, however, homeownership provides financial security which in turn creates self-confidence which most people would agree is an endearing quality (as long as it doesn’t morph into arrogance). It also provides safety and security for couples and families which can only be a good thing.

Owning your own home is a sure fire way to portray yourself as confident, successful and ambitious. You definitely shouldn’t be cocky about it though (that’s a great way to piss people off) and you definitely shouldn’t discuss your great renovation plans or hot dates at Bunnings with friends who are still renting. They will be envious enough without you having to say anything.

2. Buying your own home is a forced savings plan.

I hear economists argue that owning is much more expensive than renting by the time you take into account the extra costs like rates and insurance, so you are better off putting that extra money you would pay as a home owner into other investments, like a diversified share portfolio. While this is true for most properties in Auckland, where the owners are essentially subsidising your rental accommodation – for the rest of the country this isn’t the case yet.

The problem with the ‘rent-instead-and-save’ approach is that today’s young people are part of the now-now generation. We have unlimited global consumer choice and when we see things we like, we want them now. We have a hard time saving money at the end of each pay week (for most people this is simply not going to happen). Owning your own home is a forced savings plan. You don’t miss money you don’t have. Yes, you will be paying a lot of interest on your mortgage but some of that massive weekly payment is paying off the debt so you are forced to save whether you like it or not.

Note: At current interest rates, weekly mortgage payments in Wellington are still similar to estimated weekly rents for most houses we sell.

3. Owning a home doesn’t stop you going overseas.

I know a number of people who own property in Wellington and live overseas. Buying a property before you leave for your O.E is a great way to ensure you don’t fritter all your money away in bars in London. I understand this may not be practical for everyone but if you are tossing up whether to buy a home or go on your O.E, at least consider doing both. Buy a smaller home (like a 2 bedroom townhouse) which can be rented out easily and will have a smaller mortgage that is mostly covered by the weekly rent.

Whatever you do don’t make it Mum and Dad’s problem while you are away though. Invest the money and hire a top quality property manager to take care of your investment while you are away.

4. You control your own destiny.

Renting can be hard work. You often have to deal with private landlords who choose to operate outside the rules of the residential tenancies act. Often it can be hard to get anything fixed and in the back of your mind you know that you might get turfed out at the end of your fixed term or worse still – they might decide to put the property on the market! Then you need to deal with viewings, open homes and (gulp) real estate agents! When you own your own home you have complete control of your own destiny. You can even decide to let the lawns grow 10 ft tall or paint your house bright pink if you wish.

5. It is a proven investment.

Real estate prices don’t always go up and as with any investment you have to ride out the good with the bad. What we do know though is that houses can’t easily disappear overnight (unless mother nature decides to wreak havoc – and you can insure against this). You are extremely unlikely to lose all your money as happened to so many Mum & Dad investors when big finance companies started collapsing a few years back.

At least you can drive past your investment each day (or live in it) and know exactly where your money is. It’s also worth noting you also have more control over your investment when it comes to real estate (as opposed to shares etc) – you can add value by painting or renovating any time you like.