One thing stronger than our fear of missing out is our fear of making a bad decision.

We become paralysed with indecision and anxiety when presented with too many choices.

Isn’t it interesting how we get paralysis by analysis over something as simple as buying a vacuum cleaner, or deciding which hotel to book? You experience it on an even more intense level when you go about trying to make a larger purchase like a TV or lounge-suite. If you are anything like me, you need to consider every possible option before you make a final decision.

This ramps up ten-fold when it comes to buying property. Especially when you add in constant commentary from economists, politicians and other advisers (parents/family) who all have their own two cents to throw in…

“You’d have to be crazy to buy a home in Auckland right now!”

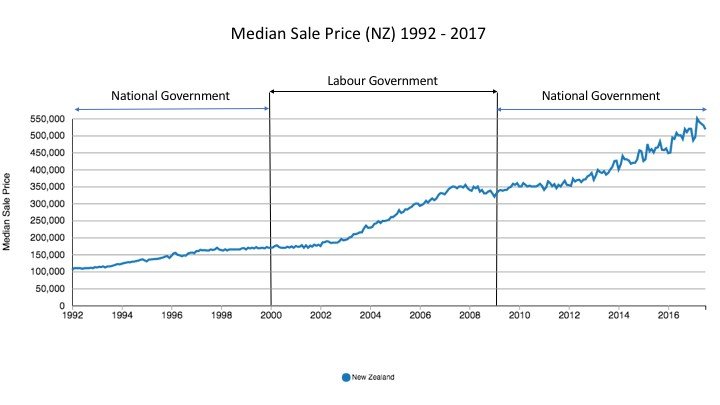

“Now that Labour is in, the market is going to tank – just you wait!”

Faced with strong and often opposing advice, the easiest option is to put off making a decision.

Will you look back and wonder, what if?

Someone very close to me, recently lamented that one of their biggest financial regrets was not buying investment properties throughout their life. They commented that the times in their life when they could afford to buy an investment property, always coincided with the point at which the real estate market appeared to be at its peak. Thereby stopping them from taking action.

Was this the correct approach? Should they have bought while they felt flush? Regardless of what the market was doing at the time?

When is the right time to buy real estate?

The benefit of hindsight tells us that the peak of the last cycle appears positively bargain-like when compared to the highs of today.

Better still, a property bought in 1992 would be paid off entirely by now (on a 25-year P&I mortgage) providing a steady income. Even if no capital gain had been achieved.

Should you run out and buy up every property you can then?

Not so fast my little property hunter. Before you go jumping in, here is another bit of sage advice:

The right time to buy is when you can afford to.

There is no doubt that buying at the peak of the market and then selling under duress 18 months later will result in you losing money. This is a situation to avoid at all costs. Especially with a leveraged asset like property, where you can lose more than just your initial deposit in extreme cases.

A rising market covers up many a bad buying decision. A falling market isn’t so kind.

One of the biggest mistakes property owners make is over-committing to a mortgage they can’t service when the going gets tough.

Before you buy, consider the following: Floating interest rates were over 10% in 2008. That is only 9 years ago. Could you afford your current mortgage or the one you are proposing to enter into, at 10.5%?

The most recent period of high-interest rates (9%+ floating) lasted 2 years (2006-2008) before settling down to the historically low levels we expect today. While many economists believe low-interest rates are here to stay, the prudent approach is to be in a position where you are able to weather that storm if it happens again.

How bad can it get? Just ask anyone over 50 what interest rates were like when they bought a home. Note: Make yourself a cup of tea first, you might be there a while.

For an investment property, ask yourself: Could you cope financially with tenants who stop paying rent?

If you couldn’t survive 2-3 months with no rent coming in (at a push) then you need to think long and hard as to whether you are ready for that financial commitment. A good alternative would be to buy an investment property in a more affordable area primed for population growth. Thereby giving yourself a smaller mortgage to cover in the event of an issue.

Christchurch & Palmerston North could be two locations worth considering.

It’s the people that only hold a property for 1-2 years that end up getting caught out. Selling is an expensive process and it cuts into your equity big time. Real Estate markets fluctuate over the short to medium term (1-4 years) but generally improve over the long term (5-8 years being the length of each cycle). You need to be able to hold on if you want to see any capital gain.

Better than that, buy a property that covers its costs and you’ll never have to worry about capital gain, or what happens to the market. Set it up with a P&I loan on a 20-year term (or shorter if you can afford it, but focus on paying your own mortgage off first) and one day you will have a paid off asset that provides you with a regular weekly income. The Kiwi dream!

Moral of the story…

When is the right time to buy real estate? You should buy a property if you know you’ll be able to afford to hold it for the next 5 years and beyond.

Hi Andrew,

I am a regular reader of your articles. I’d like to ask a question though.

Why are dual key apartment investments, not so popular in NZ?

Johnsy

Brilliant article andrew, wise and precise up to date content… keeping real..,love it!