In this weeks mailbag, we answer a common question about whether you should consider buying an apartment as your first home.

Email your question to property@andrewduncan.co.nz

Question:

“I found your blog whilst doing some research re. potentially buying our first home. I’m a firm believer in doing my homework, and in particular, getting an unbiased opinion… Hence, I was wondering about your thoughts re. our situation.

My partner and I have been renting together and our landlord is now selling. We are in a lovely sunny one bedroom apartment/town house. The building is only about three years old and in a brand new housing development in a great neighbourhood with two new schools. As well as a series of other apartments, there are also all kinds of other things opening up all around us like cafes, a supermarket, etc.

We both really love the place and it was really why we thought about buying in the first place. (As well as all the other obvious reasons). However, I am aware that this makes us more than a little biased! We have gotten independent advice re. mortgage etc. but I am unsure where I can get expert unbiased advice about the specific property.

In particular, are one bedroom houses (about 72s/m) any kind of an OK investment?

Are there any potential pitfalls when buying in an apartment that we should be aware of? (Other than body corporate fees).

Is a one bedroom an OK first step onto the property ladder? We’re conscious that we live in Auckland and our choices are pretty limited.”

Answer:

I would be open to buying the apartment, here is an outline of my thoughts/answers to your questions:

Consider getting a registered valuation done privately.

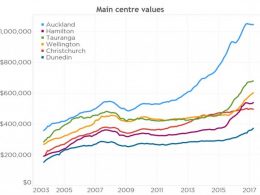

These cost around $600 – 900 so they aren’t cheap but a full-time valuer will visit your property, provide a detailed analysis of value and that can give you confidence moving forward knowing what a fair price might be. Ask them to provide you with all sales in the complex and the area over the past 12 months and earlier. Noting that prices right now (September 2017) are around 10% down on what they were in November 2016, at the peak of the market.

Bear in mind the old saying: “It’s the land that goes up in value, not the building.”

So when looking at buying property I usually side towards buying a property with some land element, however, it’s not a hard and fast rule. My favourite living arrangement I have ever had is a 2 bedroom apartment (approx 90sqm) which my Wife and I rented in Mt Cook, Wellington. It was so nice not having to mow lawns, the apartment received lots of sun and we could walk to the waterfront, restaurants, veggie markets etc. So apartment living has its positives!

Generally, properties with a land element have a higher rate of capital growth over time though, so do keep that in mind. Money isn’t the be all and end all, however, lifestyle enjoyment is far more important in my opinion.

72sqm is a good size.

In my experience, you want to stay away from anything under 50sqm as you can sometimes struggle to obtain finance on smaller apartments.

Three years old is good.

Ask for, and check the body corp minutes before you go ahead though. One risk with a really new building is that if there are any design problems they may not have come to light yet. Eg. if the place is 15 years old and there are no leaks – then you know it’s good 🙂 Do you have a builder you could ask for advice around the design method used? You could consider getting an independent building inspection done as well as a valuation and I would thoroughly recommend this. It might seem strange to do this for an apartment but you really want their general opinion on the entire structure as a whole.

Body corporates can be good and bad.

It’s nice having everything sorted but the payments can get bigger over time if there is a lot of maintenance required. Look at the body corp minutes and check what sort of sinking fund they have. Also, ask to review their long term maintenance plan.

Look at what you pay in rent vs purchase price.

If you decide to move overseas or travel down the track, how much will you have to be topping up the mortgage? Could you keep it as an investment property if you decide to move to something bigger later on?

How long have other properties in the complex taken to sell?

This is a big one. Bear in mind that some apartments can be harder to sell, especially in a down market. So it’s fine to buy one but just be aware that if you ever need to sell it they can sit on the market for a while. Note: Generally the size (72sqm) and the sun aspect will protect you a little bit here.

Conclusion…

After considering all the above, and if the checks, check out 🙂 a 1 bedroom apartment is a perfectly fine start on the property ladder.

Have you got a question? Email it to property@andrewduncan.co.nz. I’ll do my best to help.

Do you need a loan to pay off your bills? Or for your Business if yes Email us opploansllc@gmail.com