A step-by-step guide to help you through the process of buying your first investment property.

Disclaimer…

Before we get started: I am not a qualified financial adviser. This article will share tips and strategies I (and clients of mine) have used in the past that are not guaranteed to work in future. Real estate markets can change. Prices don’t always go up. Interest rates can change and were once miles higher than they are now. I insist that you obtain independent advice before committing to any serious investment decision and investment property is one of the biggest financial commitments most people ever make.

Who is this guide for?

This guide is written for a young couple, family or someone that already owns their own home. Many of the tips can still be followed if you are buying an investment property before you buy a property to live in – a strategy I am quite fond of. So if that’s you, please keep reading…

Audio version:

In this podcast episode, I interview Edwin Rakanui and we discuss his experience buying an investment property…

Follow the podcast on Spotify, Google, Apple.

Step 1: Smash out the debt on your own home.

If you have only recently brought your own home with a 20% deposit (or less) you will likely need to spend a few years reducing your mortgage to build up your equity.

What is equity? It’s the portion of your home that you have paid off (house value minus mortgage).

Step 2: Understand how much equity you have to work with.

Have you ever heard the phrase ‘no money down’ in relation to real estate? It describes the action of buying a property without putting in any cash. Imagine if you could be pre-approved by your bank to purchase a property with 100% finance. In other words, without putting in a cent of your own savings.

Q. Is that even a thing?

Yes it is, and people are doing this every day in NZ.

The key is to have enough equity in your own home first.

The bank will say you need a 35% deposit to buy an investment property (see RBNZ Loan to value restrictions). But what most people don’t realise is that this money can come from the equity in your own home, and be used as the deposit to help you buy your first investment property.

A typical example…

Imagine you own a house worth $950k. You bought it 8 years ago at a much lower price and your mortgage is now down to $400k.

So how much ‘equity’ can you put towards an investment property deposit?

If your house is worth $950k and your mortgage is $400k, then your total equity is $550k.

You automatically need to put aside 20% of the total value ($950k) as this is the equity the bank says you must have in your own home. 20% of $950k is $190k. This $190k needs to be subtracted from your total equity and will stay as the equity in your home.

So your total equity available to be used as the deposit on your investment property is now $360k

Total equity ($550k) – 20% you must keep in your own home ($190k) = $360k.

Remember, the bank will want at least a 35% deposit on your investment property. $360k is 35% of $1.02m, so from an equity standpoint, you could potentially buy an investment property worth up to $1.02m with ‘no money down’.

What’s the catch?

- The debt on the investment property will essentially be 100% which some people might find a little uncomfortable to mentally cope with. It’s worth noting that this is the absolute highest you could go from an equity standpoint based on the figures above. So a better option might be to look for a $600 – 800k property so you aren’t pushing the boat out too far.

- Bear in mind that investment property debt is generally considered ‘good debt’ by most property investors, authors and financial advisers. It’s good debt because the asset you are borrowing it to buy is one that should make money and hopefully appreciate in value, as opposed to borrowing money to buy a car, which will only deteriorate in value (bad debt).

- Another key point – the bank doesn’t just look at your equity position, they look at your ‘servicing ability’ too. This is essentially your household income. If your income isn’t reasonable, it doesn’t matter how much equity you have, the bank won’t lend you any more money. So it’s worth doing this during your prime working years while your incomes are at their highest.

Are you wondering whether your income would be high enough? Talk to a mortgage broker to find out. It never hurts to ask the question.

Step 3: Set a goal.

When would you like to buy your first investment property?

Get your family on board and make sure this is a joint decision. Naturally, one of you will lead the charge in making this happen but it’s critical everyone understands what’s involved and that everyone buys into the process.

If you have enough equity to do this and you have an emergency stash saved (more on this shortly), then a realistic timeframe would be 9-12 months or longer.

Step 4: Build up your emergency ‘stash’.

One of the keys to making money when you buy an investment property is to never have to sell. Generally, property prices move up over time, but if you are forced to sell for any reason, you could end up selling at one of the occasional low points in the market. This could result in a loss and leave you with a very bad taste in your mouth and possibly some debt.

Things can go wrong with real estate – hot water cylinders blow, you might get a leak in the roof, you can get hit with unexpected maintenance issues. On top of that and providing far more risk, is the fact that interest rates might go up.

When these things happen, you need to be able to weather the storm and ride out the bad times.

I recommend having 3-6 months worth of bare-minimum living expenses saved in a place that is easy to access before you buy your first investment property. This is money you can use if something goes wrong or if rates go up for a year or two, so you aren’t forced to sell in a down market.

This money could be in a term deposit, online savings account, or an index fund through a system like Sharesies (a system I use but have no personal connection to).

Step 5: Get your finance pre-approved.

Now that you know you have enough equity to work with, you need to check that you meet any other requirements the bank might have. It’s key to talk to a mortgage broker at this stage as some banks look more favourably on investment property funding so it’s highly possible that you could get a ‘no’ from one bank while getting an enthusiastic ‘yes’ from another.

Step 6: Decide on your criteria.

Where should you buy an investment property?

Everyone who owns a property (and many who don’t) have an opinion on this. It’s like asking ‘what is the most effective exercise routine?’. You are bound to get a different answer from everyone you ask.

When I personally think about this question the first driver that comes to mind is ‘freedom’.

I want to buy an investment property that pays for itself and ideally produces a surplus passive income so that I don’t have to keep putting money into it.

If I buy a property that needs topping up each week (eg. the expenses are more than the rent) then I am chained to my job, or at least having some source of income as long as I own that property.

Alternatively, if I buy a property that pays for itself from day 1, it doesn’t cost me anything to own and therefore, doesn’t restrict my personal freedom in any way.

A property that pays for itself means the rent covers all of the following:

- Mortgage interest at 100% lending

- Maintenance – most investors allow roughly 0.5% of the property value per year for this.

- Council rates – different in all locations, some locations are cheap, some are expensive

- Insurance

- Property management – usually 7-8% of the weekly rent

With long-term average 1-year interest rates (circa 4.5%), this means you need to buy a property with a yield of around 7 – 9% to cover all costs and potentially provide you with some passive income.

Wait, what’s a yield?

The yield is the annual income of the property (total rent) as a percentage of the total value of the property. If a property is worth about $500k and rents for $750 per week, then the yield would be:

$750 x 52 (weeks in the year), divided by $500,000 x 100 = 7.8%

That’s a property you should consider buying!

My personal criteria.

Yield is the absolute first key box to tick when looking to buy an investment property. Over and above this though, I have a few more non-negotiables.

- Simple design. Properties that have a plain layout are less likely to have long-term maintenance issues. Single-level is best, ideally with a very simple roof design and built of solid materials like weatherboard.

- Above sea level. The oceans are coming up to get us, it’s only a matter of time. So I only want to buy something that is at least 5-6 metres above sea level so I don’t have issues with insurance in 10 – 20 years’ time. I use the My Elevation Android app to check the elevation of any property I am considering.

- Location. I am happy to buy outside the main centres and you will have to cast a wide net to find a 7-9%+ yield but I want it to be in a town which is big enough not to be susceptible to collapse if one big employer or industry goes belly up. For example, Invercargill and New Plymouth are big enough, but Taumaranui might not be. Please don’t take offence if you live in a small town!

- Multi-income. I like buying properties that have multiple income streams, eg. 2 x 2 bedroom flats side by side on one title. While there is 2 of everything which needs maintaining (2 x bathrooms, 2 kitchens etc), it spreads the risk as you are unlikely to have both tenants leave at once. You can also update 1 unit at a time when needed, which keeps renovation costs down.

- Consented multi income. If you are going to buy a property that has multiple flats, then make sure the council knows it is set up that way!

Tip: Avoid competing with first-home buyers

A great way to avoid contributing to the housing crisis is to buy a home that doesn’t attract first-home buyers, like the multi-income arrangements mentioned above. You might also consider houses with fixable issues that might put first-home buyers off, like asbestos ceilings or unconsented additions. Or ones that are in such a state of disrepair that young families won’t take them on.

It’s hard enough for young families to buy a home right now. As investors, we should do everything we can to avoid competing against them when looking to purchase another property.

For more on this topic read: Are property investors making the housing crisis worse?

This is a good point to mention another podcast episode worth checkout out:

Podcast: Creating passive income through property

In this episode, I interview Nick Gentle from ifindproperty.co.nz, a nation-wide property finding service for investors. It’s full of practical tips for novice and experienced investors alike.

Step 7: Start searching.

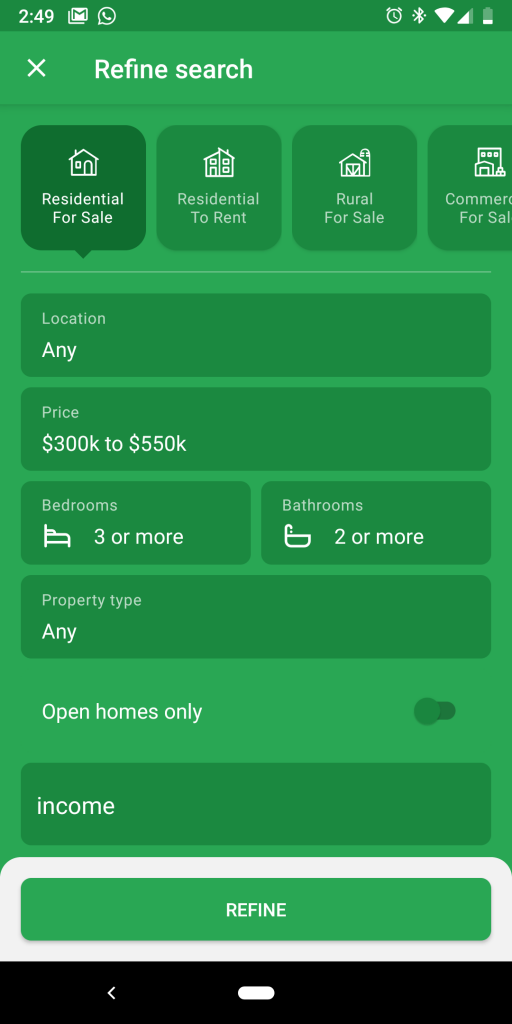

This is the fun part! It’s time to go shopping. If you are considering properties all over New Zealand, it can be hard to spot the good investments in amongst all the family homes for sale. To make things easier, set the bathroom filter to (2+). We do this since we are looking for multi-income properties which will, by design, have at least 2 bathrooms.

I also use the keyword search box to help filter the results.

When I use the TradeMe property app, this is how I search:

Where you see the word ‘income’ in the image above is where you enter your search ‘keyword’.

Other keyword search terms that I use:

- Rental

- flats

- Investment

- Return

- Yield

- Home and Income

I repeat the search with each of these keywords to ensure I don’t miss anything. As you spot something that might be of interest, add it to your Watchlist so you can review it in more detail later on.

Q. When is the best time to look for new properties?

Most real estate companies load new listings on a Monday or Tuesday. So you can ensure you will see the majority of new listings, shortly after they hit the market if you do your weekly search on a Tuesday night.

Podcast: Tag along as we visit a potential investment property…

In this episode, you get to jump in the car with us as we visit and discuss a property that stood out online as a potentially good investment.

Follow the podcast on Spotify, Google, Apple, Stitcher.

Step 8: Analysing a property & finding information

Found a property that looks interesting? Awesome! First things first, does it fulfil the criteria outlined in step 6? To answer that you need to work out the yield. To work out the yield, you need to know what it rents for.

Hopefully, the agent has put the current rent or a rental appraisal figure in the advert. If not, you can find out median rents for any area in NZ via the tenancy services website:

//www.tenancy.govt.nz/rent-bond-and-bills/market-rent/

Keep that website link saved. You are going to be using it a lot. Often properties are under-rented so you can use this website to see what the yield could be if you were able to secure market rents. The other step you should take is to email the agent directly to ask for a current rental appraisal and other property information (see Step 10).

It’s all good if a property receives a healthy rent. But that is only half the story. You need to work out the net yield. That’s how much money is left after you have paid the mortgage, insurance, rates, maintenance and property management.

To work out the rates, do a google search to find the local council that covers the area the property is located in. If the property was in Invercargill, you might search ‘Invercargill city council rates’. That will likely take you straight to the page where you can look up any property in that area online and find out the rates info.

I also visit homes.co.nz early in the process as they have estimated value info, estimated rental info, local recent sales and so much more. Download the app on your phone to make your search process even quicker.

Would you like a copy of my personal property analysis spreadsheet? Fill in the form below:

All I ask in return is that you review this blog on facebook or google.

Step 9: Assembling your team of experts.

If you have a question you don’t know the answer to, the smartest thing you can do is ask for help.

Accountant – For advice on ownership structures and tax optimisation.

Lawyer – For advice on clauses to put into your offer. Your lawyer can also check over relevant documents for you before you make an offer or during your due diligence process (LIM, title, etc)

Mortgage Broker – Make sure you get the best possible deal from the bank. They will also know which bank is most likely to give you the finance you need.

Property Manager – The quickest way to get frustrated with investing in property would be to manage the property yourself. Outsource this job to professionals.

Read: Don’t buy a home without speaking to these people first.

Step 10: Making an enquiry

Questions to ask the salesperson who is marketing the property…

- How much is the property rented for?

- Do you have a rental appraisal available?

- What other info do you have available and can you send it to me?

- Is it still available for sale?

- What is the minimum price the owners will accept?

Whatever you do, don’t say these 5 things to a real estate agent.

Step 11: Making your first offer

The conservative way to approach this big step would be to make your first offer one that you don’t expect to be accepted. Submit the offer just so you can log some experience. Once you have made that first offer and had it turned down, you will feel more comfortable with the process moving forward.

This is also a good ‘low-risk’ way to get your spouse or partner on board. Remember that if you have been the one doing all the research, making your first offer will feel like a massive step to them. Go gently here and if one of you isn’t ready to make the move, then you should hold off and wait for another property.

It’s worth remembering this is an investment property and you shouldn’t get emotionally attached to any particular option, no matter how good it looks.

For an in-depth breakdown of the negotiation process, check out the most popular post on this blog – How to negotiate like a pro.

When you find a potential investment property to offer on, you are going to need a few clauses to protect yourself.

Common examples would be: Finance / Valuation / Builders report / Solicitors approval / LIM report. Most buyers allow 5-10 working days to complete these steps.

Click here to download a .pdf file with standard clause wording. Please run these by your solicitor before submitting your offer.

Note: This probably feels like the most daunting step and to be fair, covering the entire topic of making offers and all the possible circumstances would be impossible. If you would like some strategic help here, I recommend booking a 1 on 1 consultation. It could be a highly worthwhile investment. Especially if it helps you get the right property at the right price, or avoid buying a lemon.

For further tips on making offers, check out:

What you need to know about conditional vs unconditional offers

Will the owner be offended if I make an offer below asking price?

The 5 step home valuation method

Eventually, you’ll have an offer accepted and if you are happy with the builders report / council checks and the bank comes through with the finance, you’ll be ready for the next step…

Step 12: Going unconditional

Once you are satisfied that the property is a good buy and you have done as much due diligence as possible, you will get to the point where you are ready to go ‘unconditional’. This literally means you are confirming that all your conditions have been satisfied and once you do that, you are buying the home. You can’t pull out. Going unconditional will usually trigger a requirement to immediately pay whatever deposit amount is specified in the contract so keep that in mind before you give the green light!

Do not go unconditional without speaking to your solicitor.

Usually, your solicitor would be the person who technically confirms the contract and you will need to instruct them to do so on your behalf.

Step 13: Choose a property manager.

The best way to make owning an investment property feel like a burden is to try and manage it yourself. Hiring a property manager can feel expensive, especially when everything is going smoothly. But you need to look at it as an investment, rather than a cost. A good property manager will keep rents up to date with the current market and stay on top of any maintenance requirements.

Need a property manager in the greater Wellington region? Check out Simply Rentals. Our very own property management service, run by Lynette Sletcher. No letting fees, no strange hidden costs, just good old-fashioned service.

(Disclaimer: I am a part-owner of the business)

Step 14: Setting up bank accounts / ownership entities.

This is where you need to speak to your accountant and your lawyer/solicitor to get appropriate advice. A smart idea to keep your options open is to make sure that when you submit your offer on a property, it says ‘Your Name and/or nominee‘. Those words ‘and/or nominee’ give you the flexibility to change which entity is buying the home prior to settlement.

It’s also worth giving yourself plenty of time between when you go unconditional and when you settle on the property, so you can meet with your accountant and solicitor to find out which ownership structure will be right for you.

Are you feeling overwhelmed yet?

Don’t let the scale of the task at hand put you off. You don’t need to have all the answers to start taking action towards buying your first investment property.

Follow the steps one by one and start having some fun by searching for properties online. Don’t be afraid to put offers in, even if you think they will be too low to succeed. Gaining experience is key!

Before you go…

I’ve got one more podcast suggestion for you, where I discuss the question of whether it’s possible to be an ethical property investor:

Note: Click here to check out the David Whitburn book, ‘Invest and Prosper with Property’ mentioned in the creating passive income podcast.

Hi,

Thank you for sharing such amazing tips on the topic, I was searching for the same and landed here and eventually got the right tips. Keep up the good work.

Thank you